According to Travis Kling, the chief investment officer and founder of the California-based hedge fund Ikigai Asset Management, a “vast proportion” of the company’s assets were held on the now-bankrupt cryptocurrency exchange FTX.

The headlines are not jokes and memes. Billions of dollars of people’s money is being held hostage. Howard Fischer, a partner at the law firm Moses Singer and a former Securities and Exchange Commission attorney, stated, “We just don’t know the extent of contagion.” “The first ring of victims are the people who had assets held in FTX…They are probably not going to be made whole, or anywhere close to it.”

This is due to a few factors.

The government protects customer deposits, making them whole up to $250,000 in the event of a classic US bank failure. However, in the relatively unregulated realm of cryptocurrencies, there is simply no mechanism for depositor insurance.

Theoretically, once the bankruptcy procedure is over, FTX’s clients ought to receive a portion of the remaining company assets. But it’s unclear, at least at this point, how much will be left over to distribute.

John Ray, FTX’s new CEO and chief restructuring officer, said the bankrupt crypto exchange is “in the process of removing trading and withdrawal functionality” and it is “moving as many digital assets as can be identified to a new cold wallet custodian,” according to a statement tweeted by the company’s general counsel, Ryne Miller.

While that sounds all sweet and dandy, FTX has basically destroyed its credibility overnight and there are people, like Ikigai Asset Management, who are considering having to shut down permanently.

Kling put out a statement on twitter:

“Unfortunately, I have some pretty bad news to share. Last week Ikigai was caught up in the FTX collapse. We had a large majority of the hedge fund’s total assets on FTX. By the time we went to withdraw Monday mrng, we got very little out. We’re now stuck alongside everyone else.

We’ve been in constant communication with our investors since Monday. The amount of support we’ve received has been astonishing given the circumstances, and deeply heartwarming.

It was entirely my fault and not anyone else’s. I lost my investors’ money after they put faith in me to manage risk and I am truly sorry for that. I have publicly endorsed FTX many times and I am truly sorry for that. I was wrong.

There’s a lot of uncertainty about what’s going to happen next. In the very near-term, Ikigai is going to continue trading the assets we have left that are not stuck on FTX. We’re also going to make a decision about what to do with our venture fund, which was unaffected by FTX.

Over the coming weeks and months, the timeline and potential recovery for FTX customers will become clearer. Right now, it’s really hard to say. At some point, we’ll be able to make a better call on whether Ikigai is going to keep going or just move into winddown mode….

If crypto is to recover and continue on its journey to make the world a better place, I believe the entire concept of trust has to be completely rearchitected. Bitcoin is trustless. Then we built all these trusted things around it, and those things have failed catastrophically.

Finally, please be kind to one another, here and in your daily lives. There’s way too many bad people out there for the good people to act shitty too. Have empathy for your fellow humans.”

Ikigai is not the only fund to be left holding an empty bag. Galois co-founder Kevin Zhou wrote to investors in recent days that while the fund had been able to pull some money from the exchange, it still had “roughly half of our capital stuck on FTX,” the paper said, quoting a letter it had seen.

“I am deeply sorry that we find ourselves in this current situation,” Zhou wrote, adding that it could take “a few years” to recover “some percentage” of its assets. Galois has roughly 100 million stuck on FTX.

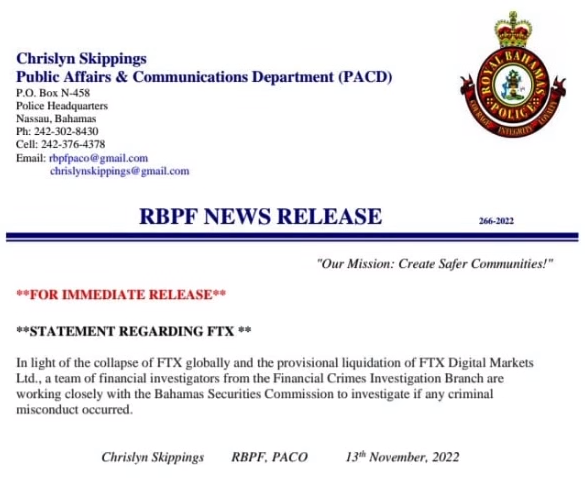

It remains to be seen what will happen to SBF or FTX. Yesterday, authorities in the Bahamas have started investigating potential criminal misconduct.

“In light of the collapse of FTX globally and the provisional liquidation of FTX Digital Markets Ltd., a team of financial investigators from the Financial Crimes Investigation Branch are working closely with the Bahamas Securities Commission to investigate if any criminal misconduct occurred,” the statement said.

It’s not clear which particular aspect of the swift collapse of FTX authorities are investigating. News of the investigation comes a day after FTX said it is conducting its own inquiry into whether crypto assets were stolen. A crypto risk management firm said the assets could be worth almost $500 million.