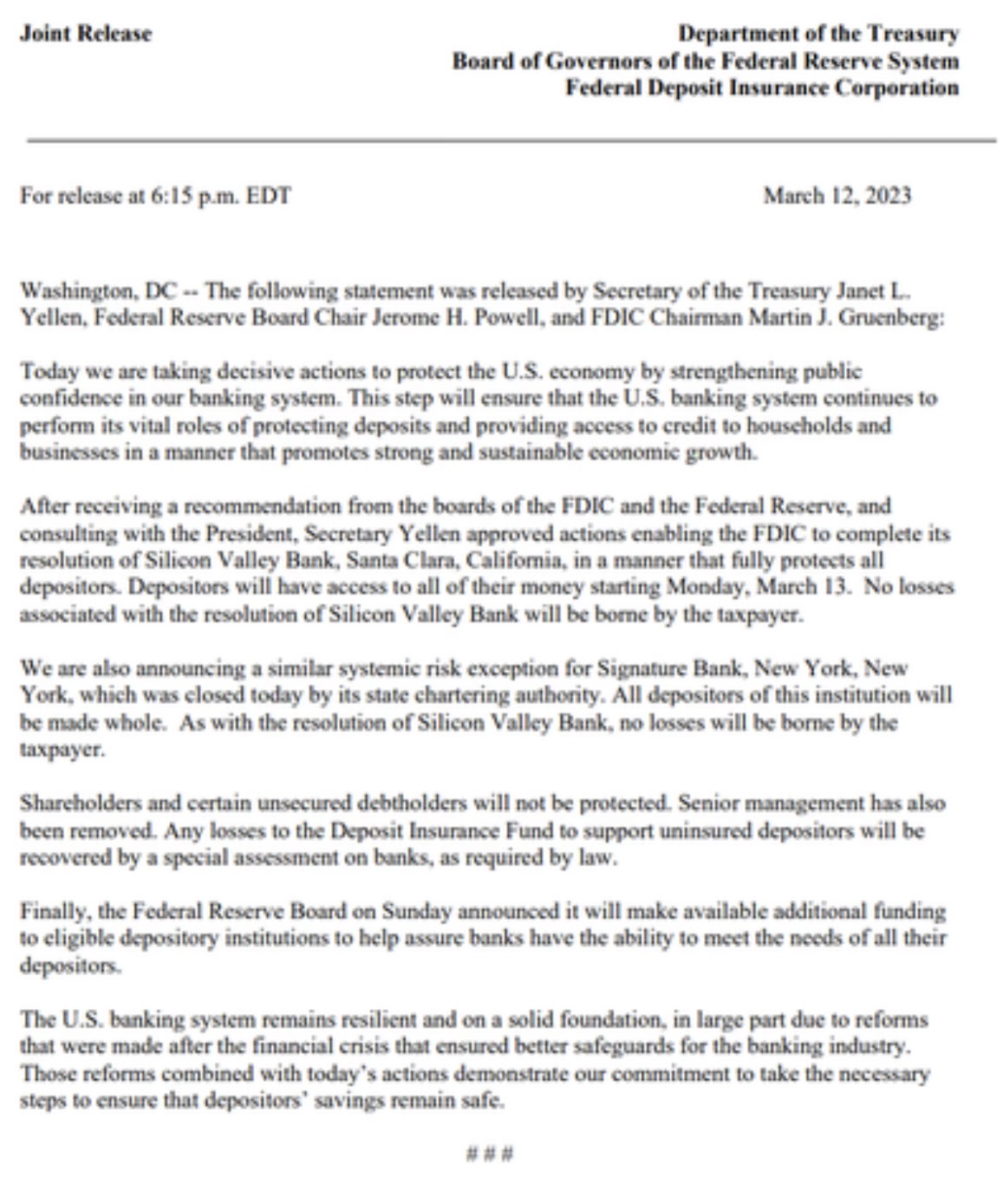

Signature Bank (SB) of New York has now been taken over by state regulators working in conjunction with the Federal Deposit Insurance Corporation (FDIC). At the end of 2022, over $88 billion in deposits were stored at SB. A joint release statement by The Federal Reserve, The U.S. Treasury, and the FDIC detailed the steps being taken to ensure banking institutions have all the funding they need. The statement spelled out that although some uninsured debt holders will not be protected, additional funds will be allocated to ensure all depositors can have their needs addressed. This will come as a relief to the depositors of the Silicon Valley Bank, as the institution was seized by regulators on Friday. With hundreds of billions of dollars at stake, regulators appear keen to cool the worries of the institutional stakeholders involved.