While speaking at a conference in Saudi Arabia on Sunday Goldman Sachs chief commodity analyst, Jeffery Currie, spoke about the effects of western sanctions on Russian petroleum production and the lack of investment in the industry. The analyst was quoted as saying, “Right now, we’re still balanced to a surplus because China has still yet to fully rebound. Are we going to run out of spare production capacity? Potentially by 2024, you start to have a serious problem.” Currie’s concerns focus on a major increase in global petroleum prices due to the combination of OPEC+ countries, like Russia and Saudi Arabia, cutting their production at the same time China rebounds from their dip in natural gas demand caused by COVID. However, he believes that petroleum-producing countries will have to tap into their spare production capacity as global demand increases. That’s where the concern over under-investment comes into play. Petroleum-producing countries could quickly run out of spare production capacity as global demand rises, this would create a deficit of supply rather than demand which could lead to skyrocketing energy prices in the global market.

Saudi Arabia’s energy minister, Prince Abdulaziz bin Salman, echoed Currie’s concerns by saying, “All of those so-called sanctions, embargoes, lack of investments, they will convolute into one thing and one thing only, a lack of energy supplies of all kinds when they are most needed.” So far this year Brent crude has been steady at around $75-$80 a barrel, but Goldman Sachs, along with other firms, is forecasting that Brent will reach $100 a barrel by may. That, combined with a decrease in spare production capacity, would lead to increased energy prices around the globe. That increased price would be felt especially hard in the EU due to the recent sanctions that have cut the EU off from Russian energy.

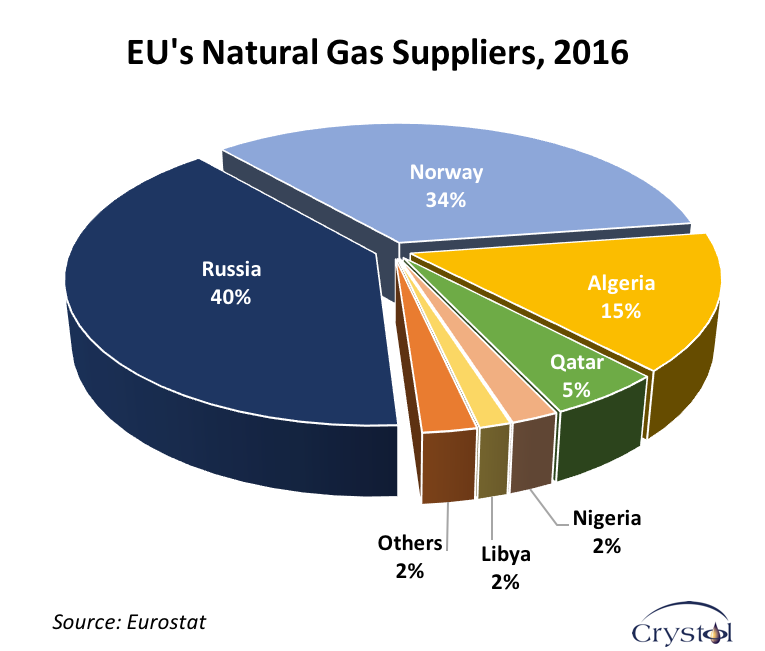

Before Russia’s invasion of Ukraine, the EU acquired 29% of its coal, 43% of its natural gas, and 29% of its oil from Russia. It will take years, likely 3 to 5, to construct the infrastructure necessary to bring in that much energy from other sources. But even if the required infrastructure is quickly constructed the EU would still run into the issue surrounding the lack of investment in the area of production. In the past, the EU has considered investing in oil production in several African nations including Namibia, South Africa, Uganda, Kenya, Mozambique, and Tanzania. But these investments needed to be made years ago in order to replace Russian oil and gas in a timely manner. All of this points to the fact that an increase in global energy prices, due to a deficit in supply, will negatively affect the whole world but especially the EU.