Jordan Belfort. Bernie Madoff. Martin Shkreli. SBF. All operated on different levels of fraud, and all were caught. But not even the ‘stratonites’ from Belfort’s infamous brokerage could touch the arrogance and stupidity of the SEC’s newest chief-clown-officer: Zack Morris of Atlas Trading. No, we didn’t open a fugazi hedge fund. Coincidentally using the same name, Atlas Trading is the subject of a new SEC suit against a host of Instagram and Twitter-based frauds. These Gucci tracksuit-wearing rented-Lamborgini driving ‘hedge fund’ masters are in fact a group of ill-experienced scammers who defrauded people of millions of dollars, and then bragged about it.

Yesterday, the Securities and Exchange Commission (SEC) has filed charges of fraud with the Southern District Court of Texas against eight social media personalities, led by Zack Morris, of a textbook pump-and-dump scheme. The regulatory body said that the group used their online platforms to rally behind a publicly listed stock to raise its price but they would dump their shares once it does, leaving regular retail traders holding an empty bag of losses.

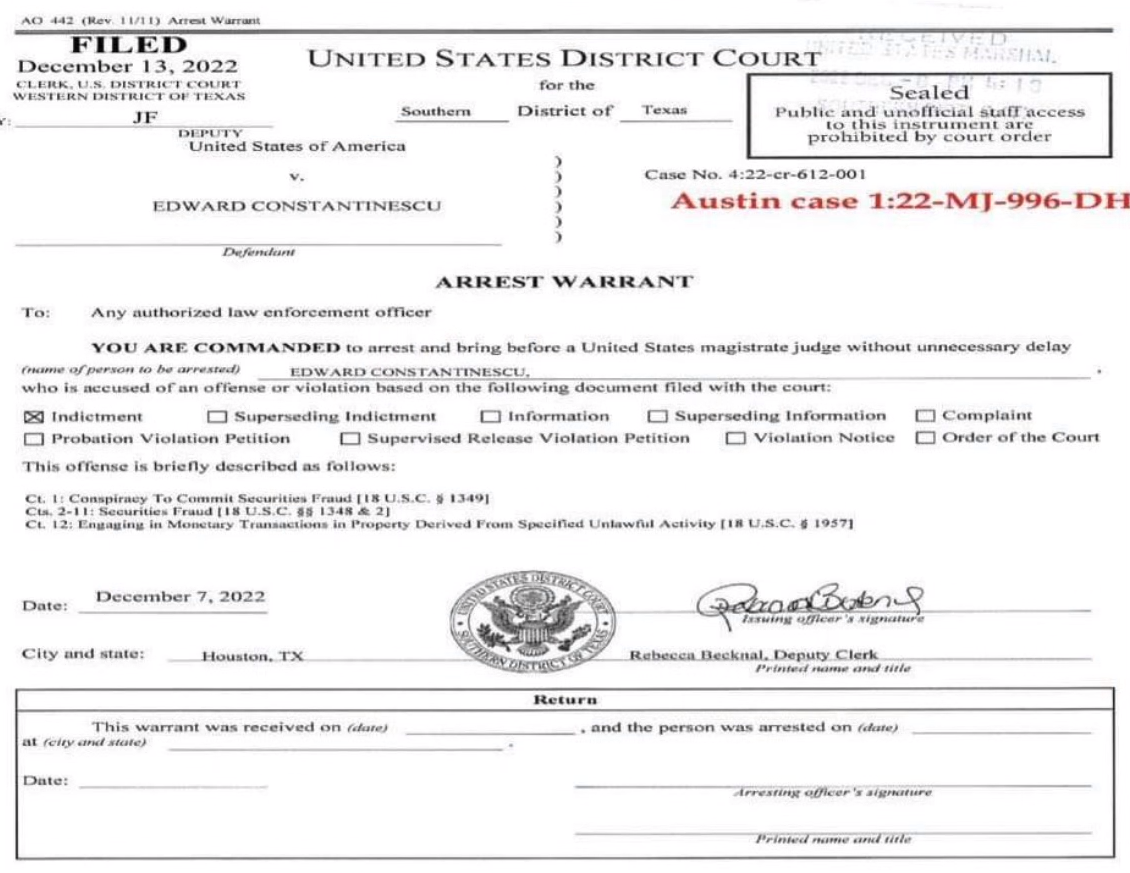

The SEC named Morris (legally Edward Constantin) as defendant together with Perry Matlock (aka PJ Matlock), Thomas Cooperman (aka Tommy Coops), Gary Deel (aka Mystic Mac), Mitchell Hennessey (aka Huge Henne), Stefan Hrvatin (aka LadeBackk), and John Rybarcyzk (aka Ultra Calls). Daniel Knight, popularly known as “Deity of Dips,” is also charged as a co-defendant in the case due to his podcast collaboration with Hennessey that was used to “aid and abet” the scam.

According to the SEC, the gang (as they would refer to themselves) “earned approximately $100 million from this stock-manipulation scheme.”

According to the allegations, the gang participated in an ongoing fraudulent conspiracy to manipulate equities by releasing incorrect and misleading information in online stock-trading forums, on podcasts, and through their Twitter accounts. The scheme allegedly lasted for multiple years. In most cases, the scheme would be carried out in the following three stages:

- Identify a security that may be manipulated, then buy shares of it.

- promote the chosen security across all of their social media platforms in order to increase demand and drive up the price.

- sell the shares at a higher price after the buzz that has been produced.

Sound like the Wolf Of Wall Street? Well, that’s exactly what they did. They would buy stock, make a tweet about a ‘big opportunity’ and when they saw their followers buy the shares in troves, they dumped them. Then they would go buy Ferraris and brag about how genius they were. Anyone who doubted them? Well…you were just a ‘hater’. Turns out, everyone wasn’t hating, they were just simply seeing through their smoke and mirrors. Or rather: vape clouds and selfies I should say. But I digress.

While you might think it takes an MBA or years of experience to expose such an in-depth scheme, you’d be wrong. It isn’t hard to see through their fraud once you realize they were not only aware of what they were doing, but they were also bragging about it. Even going as far as Tweeting to the regulators and asking them to ‘SEC deez nuts’, per a now-deleted tweet from Zack Morris/Edward Constantin.

According to the agency, the defendants claimed on their Twitter accounts that they were not providing stock recommendations or financial advice and that they were not engaged in such activities. On the other hand, they anticipated that their followers would respond favorably to their promotional tweets and planned for them to do so.

The commission had access to the secret talks that the group had been having on Discord and regarded them as the gang gloating and joking “about making profits at the expense of its followers.”

It was revealed that Knight had admitted their actions constituted “market manipulation” as early as the beginning of their scheme, in a Discord call that the SEC would describe as having been “surreptitiously taped.” An example of this can be seen in a call that was recorded in March of 2021 and describes how the group decided to promote GTT Communications, a security that was at the time traded on the New York Stock Exchange. During the course of the talk, it became clear that Knight acknowledged the fact that they are “robbing” the money from their followers who have obeyed their advice. While this was going on, Cooperman provided a summary of the technique that was being used to manipulate the market and how their “little minions” were responsible for creating the buzz that was used to boost their chosen stock.

“[The less] I mention a stock, the less likely I get involved whenever all of Atlas gets a class action fucking lawsuit… I’m playing this extremely smart, for the very long term. If you don’t think all these fuckers go to jail or at least get sued, you are crazy… playing stupid does not work in court… it’s market manipulation… I mean you look up the definition of market manipulation…” SEC quoted Knight in a February 2021 recorded call.

SEC further stated that none of the defendants revealed that they were either actively selling or actively planning to sell the selected stock that they advocated. This information was withheld by the defendants in order to draw attention away from the scheme. They would even go as far as vowing online that they wouldn’t “dump” the shares, stating that they actually lost money when the price would go down after they’ve cashed in their enormous shares of the company. They would do this in order to gain more credibility with potential investors, even going as far as saying they didn’t partake in the trade at all and simply wanted to see their followers ‘get that bag’. Obviously, this wasn’t the case and they indeed did make a lot of money.

In one instance, Rybarcyzk asserted that he had actually suffered a financial loss as a result of his investment in ABVC Biopharma, which was one of the stocks they had chosen to promote and afterward dump. In a tweet, he stated that he is a “bag holder” of the stock and that he is not going to “dump on anyone.”

But the truth is that Rybarcyzk made around $68,690 in just two days, and that includes the day that he sent the tweet in question.

Deel also pulled a stunt like this with American Resources Corporation, saying that he had lost $20,000 because “1.5 million shares were sold above 5.” However, he ended up making more than $7,000 after selling off his shares of the company the same day.

The regulatory body also estimated that Morris made approximately $4.3 million after hyping the stock of Camber Energy, which included posting price targets and projecting long holds online, and then dumping approximately 2 million shares at $2.61 after calling for a $10.00 price target. These actions brought about the profit that most likely funded his supercar-heavy lifestyle. Through the same con with Morris, Hrvatin also made a profit of $249,761 dollars.

In addition, the gang would frequently brag about their “success stories” in lavish social media posts and on their various podcasts. This added a layer of assumed competence that they would use to validate their promotion of the chosen security. The SEC says this is part of the case. That, while they claim to not offer financial advice, the promotion of a lavish lifestyle suckered people into their scheme.

The group utilized its very own stock trading forums such as Atlas Trading (which was co-founded by Morris and Matlock) and Sapphire Trading (founded by Rybarcyzk) in order to promote a particular company they thought ‘had potential’. While all of them use their Twitter accounts, which have a combined following of nearly 2 million followers, Morris holds the title of having the largest following with 551,000 followers. Knight and Hennessey have a podcast called “Pennies: Going in Raw,” which is named in the case as being a primary vehicle to drum interest in publically traded firms.

“To their legions of followers on social media, the eight defendants have, for years, promoted themselves as trustworthy stock-picking gurus. In reality, they are seasoned stock manipulators,” the SEC said.

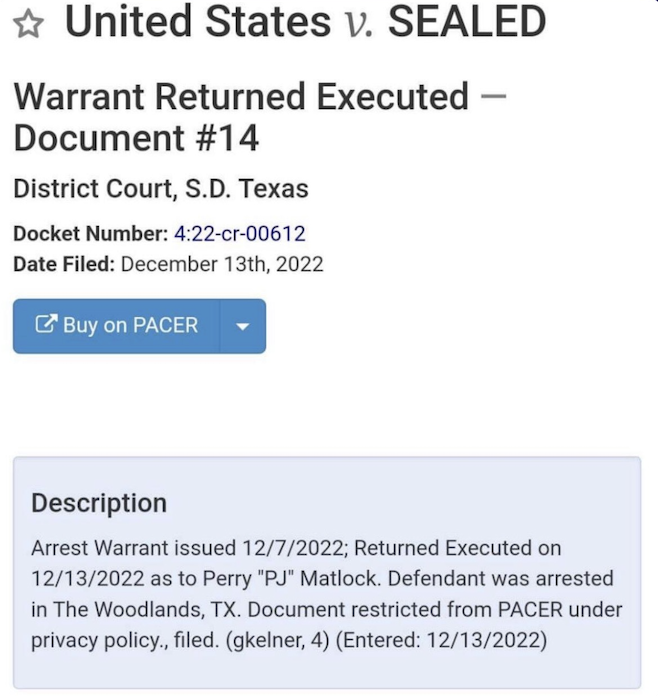

As of writing this post, PJ Matlock has been arrested in the Woodlands Texas.

According to a document filed with the court, Matlock entered a not guilty plea following his detention on Tuesday. A request for comment regarding the case was not met with an immediate response from his counsel. While PJ is the only confirmed arrest right now, I imagine it’s not long before the rest are roped up. As of this morning, Zack has still not been arrested or located.

It remains to be seen what the overall backlash of this situation will be. Daniel Knight, popularly known as “Deity of Dips” was so far into his scam he was even featured on HBO’s Gaming Wallstreet docu-series on the Robinhood Gamestop trades.

While we do not know the full extent of the people involved in this scheme, we do know that this is a case of those who were caught. Atlas Trading (again: not us), was friends with a lot of influential people and partied with a lot of influencers including Steve of Nelk Boys. While the high-profile celebrities surrounding Zack and his friends were not party to the scheme, it begs the question: who was unsuspecting of their fraud, and who unwittingly helped rob from their followers?

The SEC has officially, along with these charges, put out a warning to the general public of social media-based investment scams.

The official SEC statement that accompanied the charges reads:

The Securities and Exchange Commission today announced charges against eight individuals in a $100 million securities fraud scheme in which they used the social media platforms Twitter and Discord to manipulate exchange-traded stocks…”As our complaint states, the defendants used social media to amass a large following of novice investors and then took advantage of their followers by repeatedly feeding them a steady diet of misinformation, which resulted in fraudulent profits of approximately $100 million,” said Joseph Sansone, Chief of the SEC Enforcement Division’s Market Abuse Unit. “Today’s action exposes the true motivation of these alleged fraudsters and serves as another warning that investors should be wary of unsolicited advice they encounter online.”

While some of the followers of the ‘gang’ are sure to call BS on all of this, I ask: do you believe the exact people who may be in denial of their scheme, or the literal Securities and Exchanges Commission?

As for me, I’ll bet on the latter. And while our system definitely still operates on an ‘innocent until proven guilty’ basis, this is one of the most clear-cut cases I have ever seen. The SEC may not even have to do much investigative work as these guys are quite literally admitting to their fraud.

I’m sure there will be more information coming out within the next few months. But for now, we will have to wait and see what individual charges are brought upon them, and what their pleas entail. As for Zack, it seems his social media empire is toppling before our eyes. If found guilty, a long restitution process will entail recovering some of the funds that were illegally obtained and Zack will be forced to give up all his cars and his 10+ properties.

It’s ok Zack, if found guilty, you won’t need them. You’ll have a new home: federal prison.