t his is an interesting time, economically speaking, among everything else that is going on in the world. Following an announcement by the Federal Reserve on Wednesday, rates were raised by 25 basis points. As this is the first time Jerome Powell and his friends decided to make a move since 2018, all eyes have been and continue to glance towards the yield curve and other economic indicators. In the spirit of simplification and understanding implications in the markets, let’s do a quick review of some definitions before we go further.

The Yield Curve

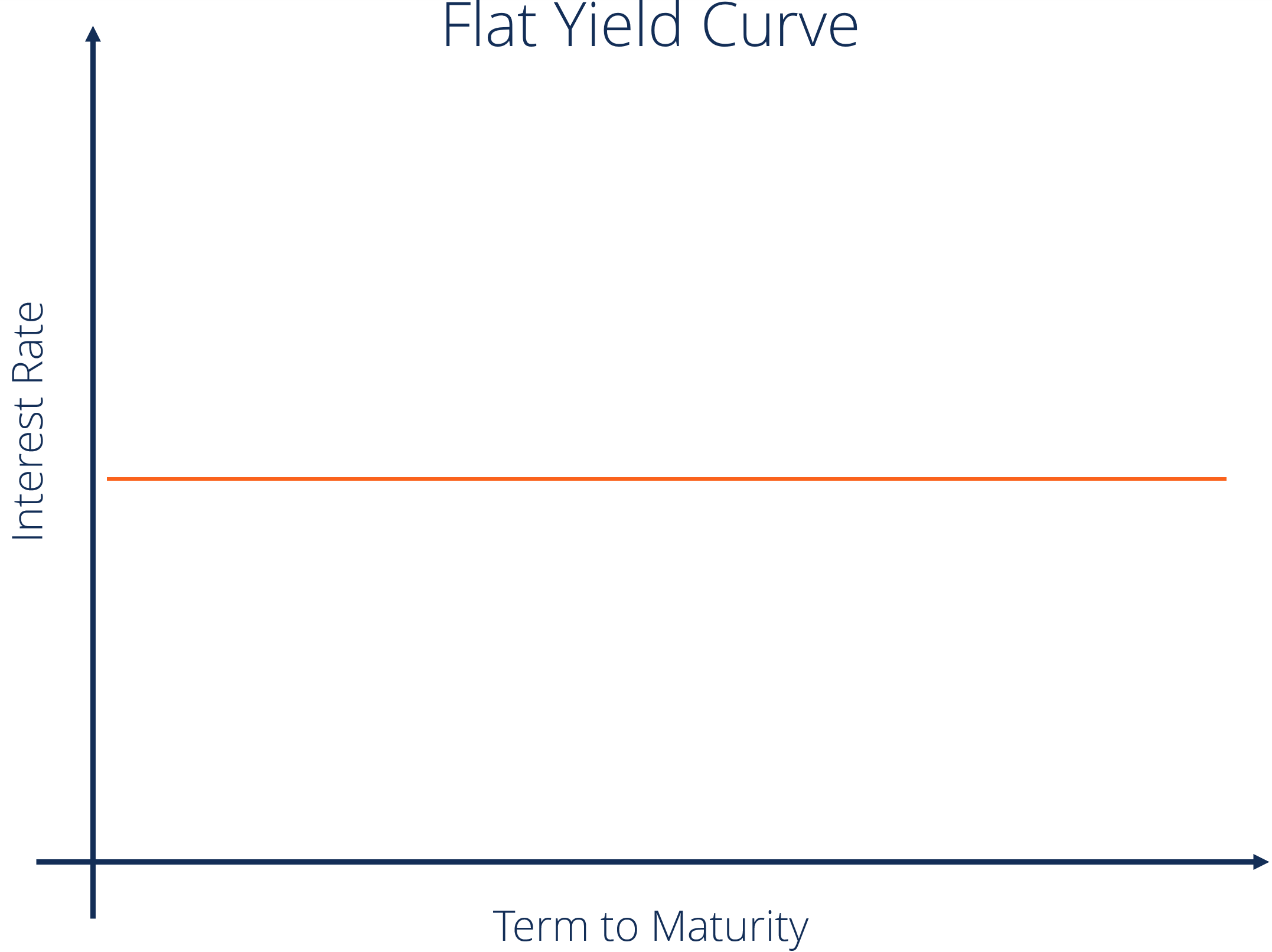

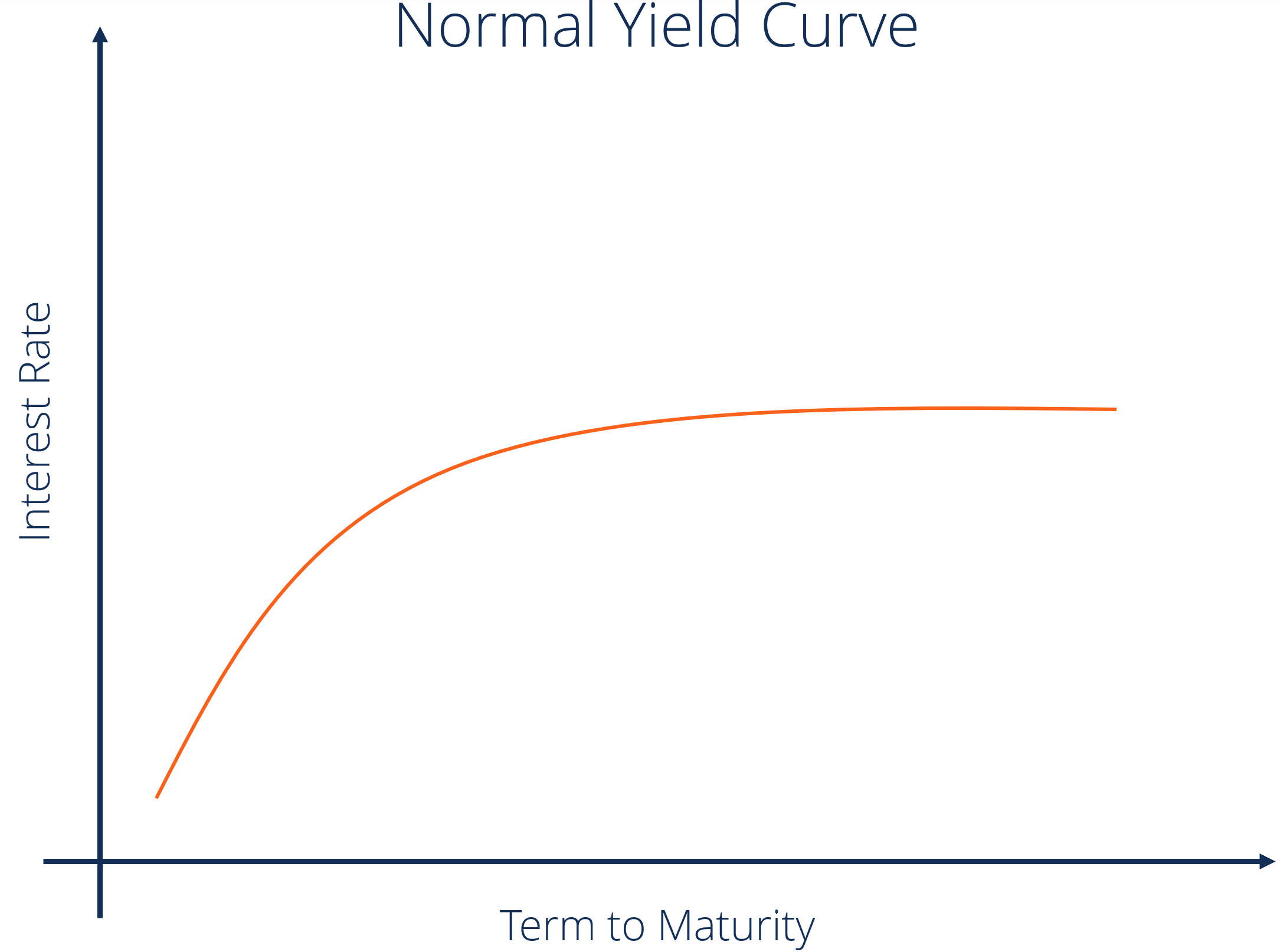

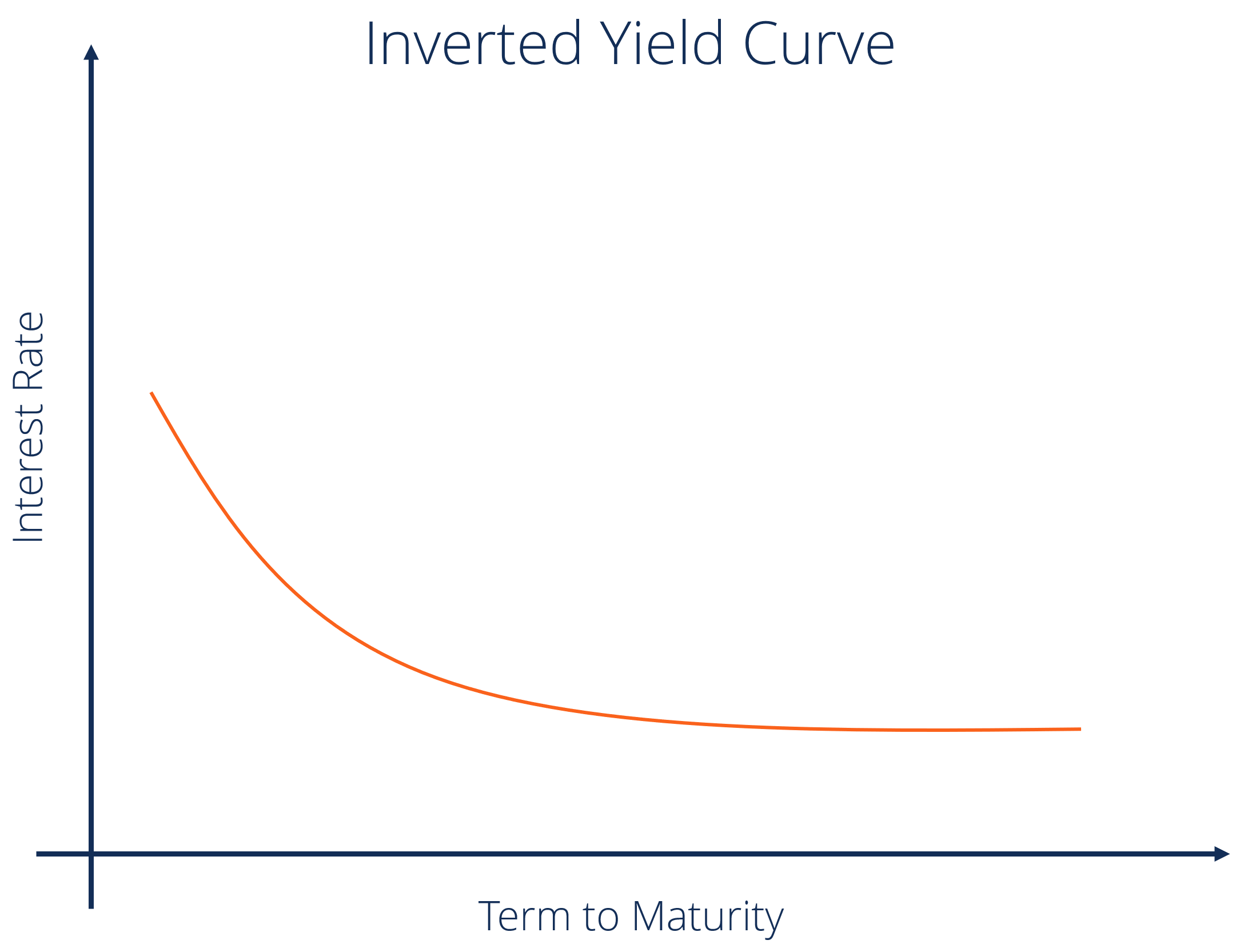

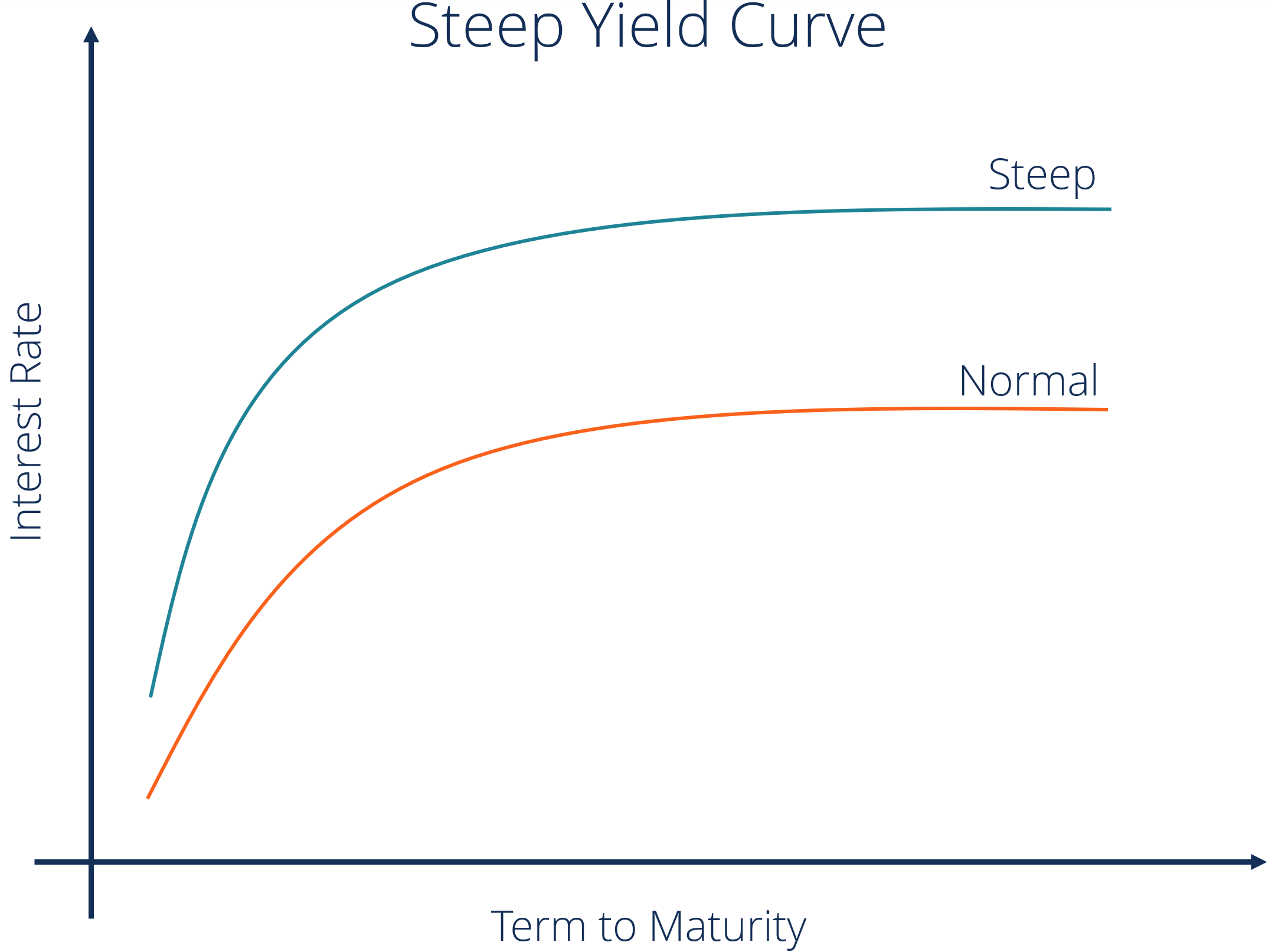

The Yield Curve is a graphical representation of debt interest rates for various maturities. It depicts the expected return on an investor’s money if he lends his capital for a set amount of time. The yield of a bond is shown on the vertical axis, while the time to maturity is shown on the horizontal axis. At different times in the economic cycle, the curve may take on different shapes, although it is usually upward sloping.

A fixed income analyst may use the yield curve as a leading economic indicator, especially when it shifts to an inverted shape, which signals an economic downturn, as long-term returns are lower than short-term returns.

The 3-month, 2-year, 5-year, 10-year, and 30-year yield curves are the most often cited yield curves. By 6:00 p.m. ET each trading day, yield curve rates are normally posted on the Treasury’s interest rate websites.

Types of Curves

There are 4 typical types of yield curves. I will briefly explain them below. But if you’d like to learn more about yield curves, economic factors, and what they mean for the everyday investor, you can read more here.

The normal curve is the most frequent shape for a curve and is referred to as such. The typical yield curve shows that 30-year bonds have higher interest rates than 10-year bonds. If you think about it in basic terminology, if you lend your money for a longer period of time, you should expect to be compensated more for it.

The inverted curve is what we see when long-term yields fall below short-term yields. Long-term investors expect that interest rates will fall in the future, resulting in an inverted yield curve. This can occur for a variety of reasons, but one of the most common is the assumption of lower inflation.

When the yield curve begins to invert, it is regarded as a leading indicator of an impending economic downturn. Historically, interest rate adjustments have mirrored market sentiment and economic expectations.

A steep curve indicates that long-term yields are rising at a faster rate than short-term yields. In the past, steep yield curves have signaled the commencement of an expansionary economic phase. The steep and normal curves are both based on the same market circumstances. The main difference is that a steeper curve indicates a bigger gap between short- and long-term return expectations.

A flat curve happens when all maturities have similar yields. This means that the yield of a 10-year bond is essentially the same as that of a 30-year bond. A flattening of the yield curve usually occurs when there is a transition between the normal yield curve and the inverted yield curve.

Sometimes there is a humped curve. This is represented when short-term and long-term yields are equal, and medium-term fields are higher. It is pretty rare and usually indicates the economy is slowing. Most of the time, you don’t need to really know this type of curve as it cannot be explained by the segmented market theory.

Factors that influence the curve:

1. Inflationary pressures

When predicted inflation rises, central banks typically respond by raising interest rates. As a result of the decline in purchasing power caused by rising inflation, investors anticipate an increase in the short-term interest rate.

2. Economic Development

A rise in aggregate demand may lead to an increase in inflation as a result of strong economic growth. Strong economic growth also means that there is more competition for cash, as investors have more investment possibilities. As a result, rising economic growth leads to higher yields and a steeper curve.

3. Interest Rates

If the reserve bank boosts the rate of interest on Treasuries, this will stimulate demand for treasuries and, as a result, interest rates will eventually fall.

What does all of this mean?

With running the risk of sounding condescending with that explanation, I think it does serve the purpose of putting things into context. I believe, as I had mentioned before, that understanding headlines and what they mean for you is of utmost importance, and if I can be a small part of that, great. Let’s dive in:

When short-term yields exceed long-term yields, it isn’t a good indicator considering investors normally want greater compensation for tying up their money for longer periods of time. However, that link no longer holds in at least one area of the Treasury market. Just two days after the Federal Reserve raised interest rates, 3-year bond yields surpassed 5-year bond yields for the first time since 2020.

Following the interest rate hike on Wednesday, the 3-year yield briefly topped the 5-year this morning. This doesn’t necessarily mean a recession is imminent, but it is an unusual sign nonetheless. While the 3- and 5- year curve isn’t really used to indicate anything, it still is worth noting. But usually, investors and economists really look for the gap in the 2- and 10- year yields. In this comparison, the 2- and 10- year gaps have accurately predicted every recession since the 60’s.

Two primary variables influence Treasury yields: Federal Reserve rates and inflation expectations over time. In a nutshell, market observers might conclude from Friday’s inversion that global investors expect US interest rates or inflation to peak in three years. That isn’t a significant issue in and of itself. However, if the peak happens as the economy enters a downturn, investors may be more concerned—and there are numerous uncertainties about whether the Fed can keep inflation low without creating a recession.

I just wrote a piece on how one strategist says a recession is likely due this summer, citing the Fed and their inclination to hammer inflation. You can read that here.

The 3-month yield is still well below the 10-year yield, with a healthy 1.7-percentage-point gap. So investors shouldn’t panic. But they may want to keep an eye on the bond market. But, the gap between the 2- and 10- year yields is narrowing. That is a scarier sign.

Here are some comments following this morning’s inversion:

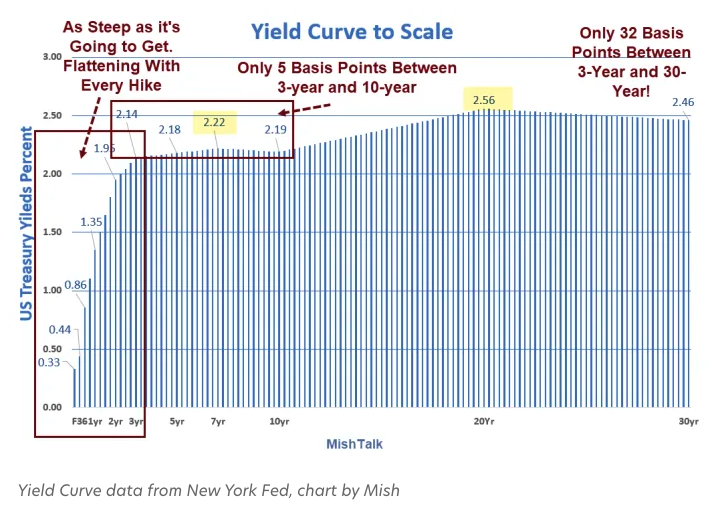

- The front end of the curve is as steep as it’s going to get. Every hike will flatten the front end.

- The Effective Fed Funds rate rose by a quarter-point to about 0.33 percent from 0.08 percent.

- At one point on Wednesday, the spread between the 5-year and 10-year notes inverted. The 5-10 spread closed at 1 basis point.

- The 7-10 spread is inverted by 3 BPs.

- The 20-30 spread is inverted by 10 BPs.

- The 5-10 spread is 1 BP.

- The 3-10 spread is 5 BPs.

- The 2-10 spread is only 24 BPs

- The 3-30 spread is only 32 BPs

Less than a year ago the 2- and 10- year spread was 159 basis points. With only one single hike on Wednesday, the spread decreased to 24 basis points. Unless the 10-year bond further sells off resulting in a yield rise, another Fed quarter-point hike will most likely flatten the 2-10 year spread, if not invert it.

Slatestone Wealth Chief Market Strategist, Kenny Polcari, gave his thoughts on recession and the Federal Reserves’ recent moves. He said, “I think [Jerome Powell] could have acted more aggressively. I think he’s behind the 8ball and he knows he’s behind the 8ball…my guess is inflation has an inclination to move higher, and it won’t respond right away.” Which the markets seem to somewhat agree with. Powell has seen some criticism for not being aggressive enough. In a time of such conflict in Ukraine and uncertainty in the housing market, the Fed shouldn’t be seen taking a ‘let’s see what happens’ approach.

Polcari continued, “[Powell] is going to find himself having to move forward more aggressively this summer. I think they should have moved more aggressively now. I think they should have moved harder now, and again in May. If they would have increased 50-50 (basis points for each hike), we would be up 1% by the summer.”

If a recession is incoming, the question begs: what do you do? As an investor? The usual moves are going into a high dividend-paying stock or converting a lot of investments into cash. Unless you’re 80, historically speaking, sticking to your investment strategy is usually the best move. This may mean laying off some big-name power movers and going to boring plain picks, but you should be alright.

But as all of this unfolds, let’s remember one thing: no one can accurately predict the future. Especially in the world we live in now. The economy and markets we saw during a worldwide pandemic brought on some insane growth periods. If you told me at the beginning of 2020, that a WORLDWIDE shutdown would happen, coupled with one of the best years in the markets maybe ever? I would have not believed it.

Let’s see where the markets and economy go from here. But like I mentioned Wednesday, with how the government works, we likely aren’t getting any help. Powell is weak on raises, Biden loves to spend money like there’s no tomorrow, and the slack is picked up by institutional and retail investors. If we got through the last two years without a recession, I think we should be fine. But today’s inversion in the yield curve is something we should all be paying attention to.

Stay tuned.