The Russian Economy

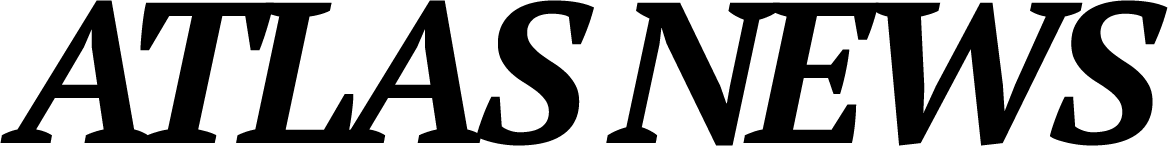

In order to understand the effects of the ongoing sanctions against the Russian Federation, we must first examine the Russian economy. Russia is the largest country by land mass on  Earth, occupying 11%, with the next leading countries being Canada, then China, then the United States, each around 6%. By virtue of being the largest country in the world, Russia is a leading energy and grain producer, despite only having the 11th largest economy. In fact, in 2021, Russia only contributed about 1.7% to the global GDP, signaling a weak integration that was primarily dominated by the energy sector. In 2020, oil exports accounted for nearly 37% of Russian exports, while Liquefied Natural Gas (LNG) accounted for 11% of exports, all in all accounting for 36% of the revenue for the Russian Federation.

Earth, occupying 11%, with the next leading countries being Canada, then China, then the United States, each around 6%. By virtue of being the largest country in the world, Russia is a leading energy and grain producer, despite only having the 11th largest economy. In fact, in 2021, Russia only contributed about 1.7% to the global GDP, signaling a weak integration that was primarily dominated by the energy sector. In 2020, oil exports accounted for nearly 37% of Russian exports, while Liquefied Natural Gas (LNG) accounted for 11% of exports, all in all accounting for 36% of the revenue for the Russian Federation.

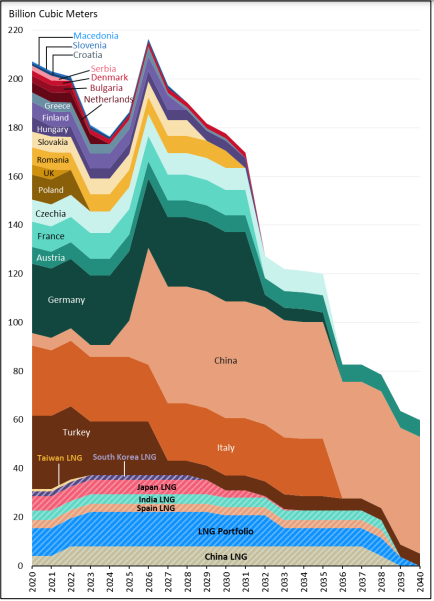

The United States Congressional Research Service’s Study of Russia’s Role in the Economy shows us that the Federation ranks relatively low in exported/imported goods and services, but excels in energy production, being 2nd in the world for Liquefied Natural Gas (LNG), behind only Qatar who also leads in LNG exports. Despite being 2nd in the world for LNG production, Russia only ranks 4th in LNG exports, behind Qatar, Australia, and the United States. This is mostly due to localized exports of LNG and oil products to European markets. In 2020, 78% of Russian LNG went to European nations, 11% to Asia (mostly China), and then 11% to the rest of the world. This also works in Russia’s favor by removing it from global supply chains; in 2020 83% of Russia’s LNG traveled via pipeline, with only 17% traveling by ship. The relationship between Russia and the EU in regard to LNG and oil has become critical in that 44% of the EU’s supply comes from Russia. This relationship with European markets creates an especially tricky relationship when discussing unified sanctions. In fact, Austria, Bulgaria, Estonia, Finland, Hungary, Latvia, Poland, Slovakia, and Slovenia import more than half of their consumed LNG from Russia. This is due in large part to the nearly 15 year decline in EU LNG production, in order to truly appreciate this decline, EU LNG production was down 59% from 2011 to 2020.

In 2021, Russia exported 492B USD, with about 50% of these exports being minerals, oil, and gas. While the exports of oil and gas from Russia are widely known, it is worth noting that the Russian Federation is the leading exporter of Neon, Palladium, and Titanium, all heavily used in automotive and aircraft manufacturing. The primary recipients of these exports are Germany and the Netherlands and other EU nations, followed by China and Turkey with the United States receiving about 4%. However, while Russia enjoys an advantageous relationship in energy exports to Europe, it is severely disadvantaged through its reliance on the importation of machinery, electrical machinery, vehicles, pharmaceuticals, plastics, optical, articles of iron or steel, iron, and steel, edible fruits & nuts and rubber. The Russian military is currently feeling this burden as its manufacturers have been unable to supply its ground forces with replacement parts for their aging tank park in Ukraine.

Sanctions Over Ukraine

Now that we have a grounded sense of the Russian economy, it is time to look at the sanctions imposed on their economy since 2014. It is important to note the international community, led by the United States and the European Union has struck Russia with four waves of economic sanctions in response to aggression against Ukraine, starting in 2014.

The First Wave

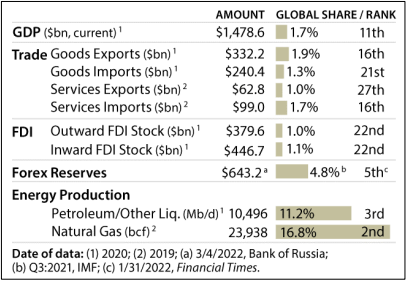

In March of 2014, in response to the annexation of Crimea, the United States, the EU, Canada, Japan, Australia, Albania, Iceland, Montenegro, Ukraine, and other countries enacted sharp travel bans, property seizures, and froze assets of “persons directly responsible for undermining democratic processes and institutions of Ukraine”. These targeted sanctions mostly fell on Russia’s political, commercial, and military leaders. Japan was the first nation to completely ban any military talks, space exploration, and visa requirements, with other nations following suit on 19 March 2014.

The Second Wave

In April of 2014, the United States expanded personal sanctions to dozens of Russian oligarchs and more than 17 companies, including Rosneft and its CEO, Igor Sechin. The EU also responded with travel bans on about 15 oligarchs and their families.

The Third Wave

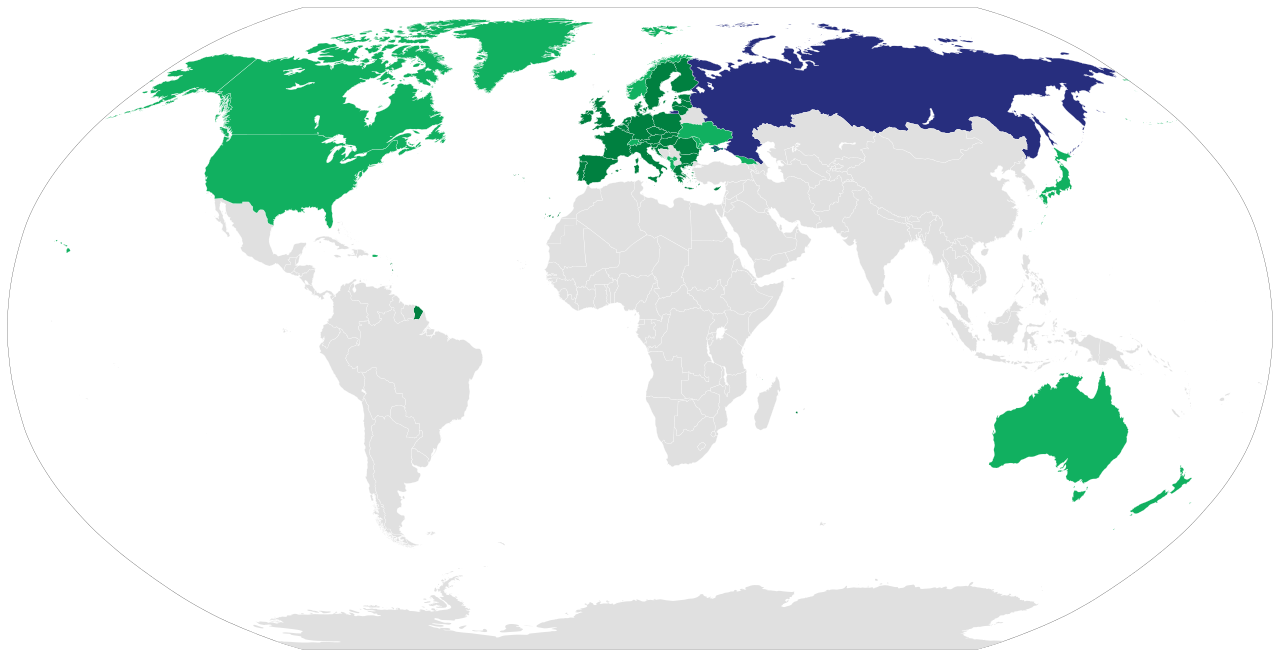

In response to the escalating war in the Donbas during July of 2014, the United States, the EU, and several other nations including Canada, Japan, Australia, Norway, Switzerland and Ukraine began a yearlong wave of sanctions that expanded personal restrictions of travel and business dealings to more than 200 Russian citizens and several Russian companies. The US, the EU, Japan, and Canada especially sought to target Russian arms dealers, banks, and energy firms. Targeted sanctions hit Gazprombank, Rosneft, Novatek, and Vnesheconombank. By the end of 2015, the Russian Ruble had collapsed and Russia was facing a financial crisis, costing the Federation nearly 40B USD. By 2016, President Putin accused the United States of leading a global coalition to destroy Russia, acknowledging they had probably lost 170B USD from sanctions and another 400B USD from lost revenue in gas and oil, due to buyers shifting to Saudi Arabian oil. Ukrainian officials praised these sanctions, crediting them with delaying Russian aggression towards their nation.

The Fourth Wave

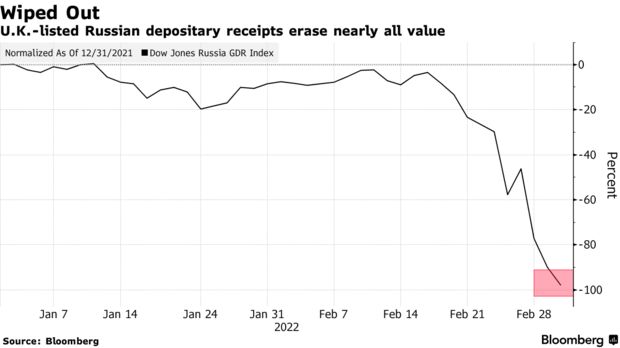

On February 24th, 2022 the Russian Federation invaded Ukraine with a combined arms campaign kicked off by a salvo of more than 100 Kalibr cruise missiles, tac-air strikes, and mechanized infantry movements on four major axes. However, the international community, in a rare show of unity, imposed the harshest sanctions the Russian Federation had faced yet.

On February 25th, the United States, Taiwan, Singapore, the EU, and most noticeably, China levied harsh sanctions on Russia. The Central Bank of Russia was blocked from accessing nearly 400B USD in internationally held assets. The United States moved to ban the import of all Russian oil and gas products and led an international coalition to remove Russian banks from accessing SWIFT, the global messaging system for international payments, except when used for gas payments. The United States also instituted a rare export control that blocked American companies from trading high-tech components with Russia, claiming that the intellectual property of the U.S. government would not be used to buoy the Russian invasion of Ukraine. This included aircraft engines, military-grade optics, semiconductors, and encryption software to name a few. Private companies such as Visa, MasterCard, McDonalds, Maersk and dozens more, ceased operations in Russia in order to avoid sanctions fines and to stand in solidarity with the people of Ukraine. All in all, French Finance Minister Bruno Le Maire said that Russian assets being frozen by sanctions amounted to one trillion USD.

Solving The Sanction Problem: China

Since 2014, US and EU sanctions have twice caused recessions, and in one case the collapse of the Russian ruble. This has caused the Russian Federation to seriously reconsider its market for its number one export: energy. In 2020 Russia opened its first LNG pipeline to China, while also contracting to build another. Conservative estimates at the time of the invasion charted China to become the number one buyer of Russian LNG by 2026. It is probable that the extreme sanctions of February and March 2022 have accelerated that timeline. However, that is not the only way Russia plans to get around future Western sanctions.

After the 2014 annexation of Crimea, Russia recognized its vulnerability in relying on SWIFT, so it created its own financial messaging system, the System for Transfer of Financial Messages, or SPFS. Although, so far, most domestic Russian financial intuitions use this, with only a handful of foreign institutions in Belarus, Cuba, China, and Kazakhstan. However, Chinese officials have hinted at the possibility of joining SPFS with China’s Cross-Border Interbank Payment System, or CIPS. While the two systems are a long way off from being able to match the volume of SWIFT, this is an option Russia can use in the future to limit international sanctions, and vice versa for China.