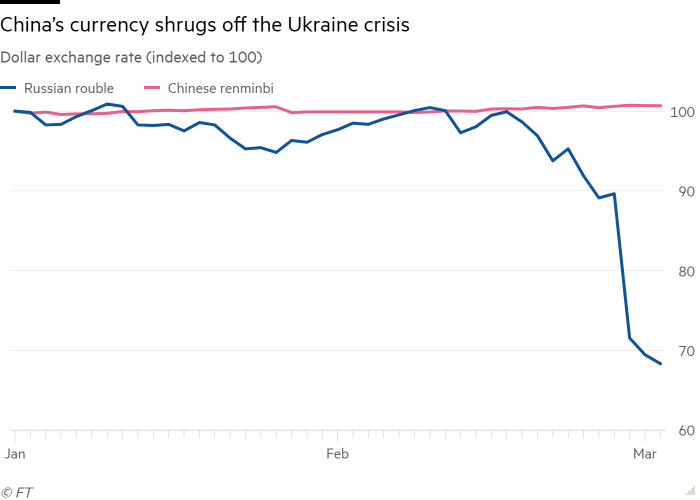

It’s no secret that China is Russia’s most strategic ally. And even in the time of war, they seem to only support the invading country in ways that benefit them. Sanctions levied in response to Russian President Vladimir Putin’s invasion of Ukraine have dealt a devastating blow to his country’s financial system and left the ruble down around 30 percent this year.

But the renminbi, the official currency of the People’s Republic Of China and a major world currency, has remained stable. In fact, the currency has extended a 5 months-long run of resilience despite a recent slowdown in the growth of China’s economy. Central banks are looking towards the renminbi to diversify their foreign currency holdings in a sign that geopolitical flare-ups could chip away at the dollar’s dominance.

There are increased talks of how the currency could become more of a staple in the world economy, as it seems to hardly fluctuate around geopolitical movements around the globe. This isn’t just happenstance. This is the epitome of China’s plan after spending 20 years trying to globalize the renminbi, by using it as a store of value against the international competition of currency, as well as increasing its use in foreign trade.

Why Should You Care?

You read that, but now you want to know: why should I care? What is the point? In grad school, one of the most valuable things I was taught was that the technical knowledge of financial tools is useful, but the most important skill we could learn was why things happen and what they mean. So here is my attempt.

Wider usage of the renminbi across the globe would, theoretically, make it easier for China to break what it views as US and western hegemony in the global financial markets – control that has been on the world stage in recent weeks in the efforts to punish Putin and his economy.

There are signs of growth that need to be noted, such as the Chinese currency outpacing Japan’s yen in the SWIFT payment ranking. At the same time, Standard Chartered’s renminbi globalization index indicated that the currency has reached a record high in its global standing.

But the real goal for China is to move away from the SWIFT system. In recent years, they have made advancements in their own system, CIPS. The Cross-Border Interbank Payment System rose around 20% to Rmb45.2tn ($7.1tn) in late 2020. CIPS has approximately 1,200 member institutions in about 100 countries but has fewer members than SWIFT, which has approximately 11,000 members.

Here is where it gets spicy. With so many Russian institutions leaving or being outright banned from SWIFT, the increasing availability of China’s CIPS starts to seem more attractive. Russia’s homegrown clearinghouse isn’t robust enough, so that really isn’t an option for native businesses. And let’s be honest, no one really wants to take part in a financial payment system run by someone who, as of this very moment, is being accused of war crimes and is actively invading another country.

But that doesn’t mean that the US system will still be the go-to. Obviously, the US Dollar is the leading currency, and that probably won’t change anytime soon. However, there are some concerns over the bully-ish tactics that the west plays on the world stage, in regards to currency. This is the most attractive reason for foreign businesses and institutions to move toward a payment system run by people who align with their views towards the west.

Academic Benjamin Cohen, an authority on international monetary affairs, said:

“Every time the US and its allies make access to the dollar a weapon, it creates an additional incentive for the Chinese to take advantage at some point…It’s not a case of the Chinese wolf at the door [of US dollar hegemony], it’s more a case of termites in the woodwork.”

Iran, North Korea, and Venezuela are further motivated to diversify away from the Dollar as sanctions are imposed against Russia. While CIPS was originally started in 2015 as a response to the sanctions imposed on Russia for the invasion of Crimea (yes, it seems like we are in the twilight zone sometimes), it has grown a lot in recent years as China aims to pick up the pace.

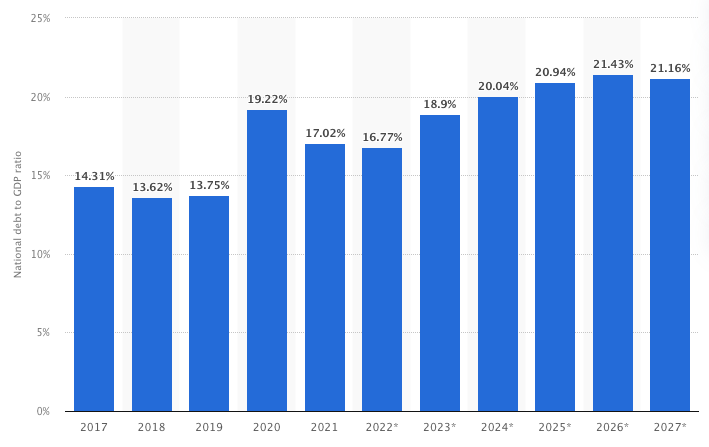

All of this comes as the Russian ruble is taking a beating, and as China continues to pick at western economic dominance. Can you imagine what the charts will look like in a few months’ time? Years time? With the sharp decline in the value of the ruble, their obligations to their debts remain the same, and it’s only getting harder to pay them. Statista, along with many economists around the world project Russia’s debt-to-GDP to surpass 20% by 2024. All of this comes on the heels of news that Russia Has Slipped Into Historic Default as Sanctions Muddy Next Steps.

Pressure Has Been Mounting For Awhile

Beijing and Moscow have made it a priority to remove the US dollar from their trade settlements since 2014 due to Russia being a major supplier of oil and natural gas to China. Again, this was a direct response to the U.S’ response to the Crimea situation. The two countries’ central banks signed a currency swap agreement that year, and it was recently renewed for Rmb150bn. The renminbi also occupies a large chunk of Russian foreign reserves thanks partly to a 2019 agreement allowing China to buy Russian gas in its own currency. A January report from Russia’s central bank showed renminbi assets worth $73bn at 13% of total reserves.

All of this means one thing: the more the world currency markets fluctuate due to any type of conflict, it creates the opportunity for China to finagle its way into globalizing its renminbi even more. Heavy sanctions in recent weeks are evidence of that. Bruce Pang, head of research at China Renaissance, indicated that the only risk they see so far is the US and allied countries imposing sanctions on China itself. This would cripple their ability to support Russia and expand CIPs. But it’s tit-for-tat. What would be the global implications in commodities, oil, trade, etc, if the US placed sanctions on Russia and China, essentially starting an economic world war?

Obviously, sanctions that rival that of the ones placed on Russia, would only be placed on China if they follow in suit and invade Taiwan. So what happens in Taiwan will likely be influenced by what happens in Ukraine. If Russia succeeds in overtaking Ukraine (unlikely but that’s just one man’s opinion), it increases the danger for Taiwan. If Russia ultimately retreats or suffers lasting, damaging consequences, that could be good news for the island. But the China situation is different. Taiwan, unlike Ukraine, is not recognized as an independent country across the world — not even by the United States — raising issues about whether China’s strike would be considered an invasion at all, or a really messy ‘territorial seizure’.

Experts say any invasion of Taiwan might not happen for years if it happens at all. This allows China time to strengthen its military, shield its economy from any sanctions, analyze what Russia did wrong in Ukraine, and assess if Western resolve is truly unbreakable.

But there is no denying it. The Ukraine situation is something to be watched closely, outside of the regular elements of a given war. This invasion is good for China. Either their backing into Putin pays off, and they see how an invasion of Taiwan might play out for them. Or, it fails, and they strategize what went wrong, and how to improve. But one thing is for certain: besides territorial dominance, China is also wanting to establish economic dominance. And heavy sanctions against China, if an invasion did occur, would only strengthen their CIPs system and the renminbi, as is evident with the sanctions placed on Russia.

Four-fifths of the central bankers surveyed said they believed that a move towards a multipolar world — away from a US-centric system — would benefit the renminbi. Less than half said it would benefit the US dollar. And the world will move away from a US-centric system as more sanctions get placed.

Short-term sentiment toward the dollar has also been impacted by worries about the US’s high inflation and the Federal Reserve’s efforts to combat it. Normal holdings of US government securities by central banks have been drastically reduced this year as a result of the Fed’s tightening of monetary policy.

This isn’t to say that the US dollar is on the brink of collapse, or anything apocalyptic in nature. To be fair, this country has seen worse, economically speaking.

Food for thought.

Stanford Nix is the Chief Operating Officer of Atlas News. You can follow him on Twitter @_atlasnews